Martin Gross is Certified FRC (Federal Retirement Consultant)

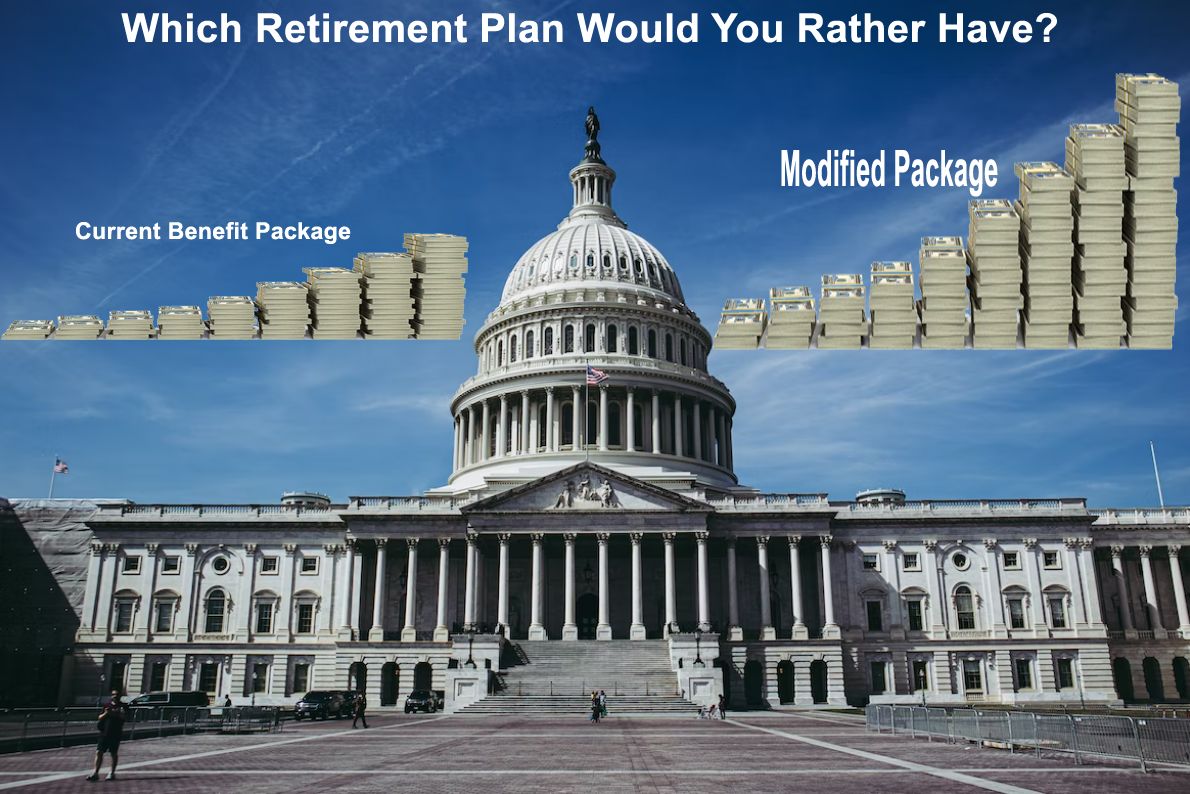

The benefits available to employees of the Federal Government are Great! ARE THEY?

You be the judge. The feds do not provide very much assistance and, as a result, most Federal employees typically spend more than 20 years working there, and have no idea what they have or what to do with their assets when they retire to the “retirement country club”. Some are able to achieve that ideal retirement dream but most are not.

The Federal Retirement Plan is comprised of 3 main parts:

- Pension aka FERS (Federal Employee Retirement System) Pension

- TSP (Thrift Savings Plan) – Similar to a 401K

- FEGLI – Federal Employee Group Life Insurance

Sounds Great – Right? – Let’s take a look.

Here’s a 30,000 ft view.

Let’s be a little more specific:

FERS Pension

-

- You can qualify for a lifetime pension by working for as little as 5 years

- The pension can be as much as your highest consecutive 3 year average income times the number of years of service times 1.1%.

for example:

20 years of service with an average income of $100,000 will provide a $22,000/yr pension for the rest of your life.

- The bad news is the pension available for a surviving spouse in the event of your death is substantially lower at a significant cost. There are better ways.