Selecting the right strategy for when to claim Social Security will pay off for years to come. But there’s a lot more to maximizing your benefits

As you approach retirement, figuring out when and how to claim Social Security benefits is one of the most important tasks on your to-do list. Choosing the right time and best strategy could significantly boost your income—and the stakes are particularly high for couples. Many retirees and pre-retirees are struggling with the complexity of their choices. The best decisions for you depend on your own circumstances, but knowing the basics will help you choose the right options. Here, we’ve answered several of the most common questions.

How does my life expectancy factor in to what age to claim Social Security benefits.?

First, the basics: You can start getting benefits as early as age 62, but you’ll receive up to 30% less in each check than if you wait until your full retirement age, which is 66 for those born from 1943 to 1954 and gradually rises to 67 for those born in 1960 or later. For each year after your full retirement age that you wait to start benefits until the maximum age of 70, you’ll get an 8% boost in delayed-retirement credits. See the table below:

Social Security actuaries aim to set payouts so that if you die at the time your life expectancy projects, you’ll receive about the same total amount of benefits no matter when you start claiming them. If you are single and have never been married, spousal and survivor benefits aren’t a concern, so your decision about when to claim hinges on how long you think you’ll live. If you can afford to postpone taking benefits and are deciding whether to hold out to age 70, a key question is whether you expect to live past 80. Research shows that at about age 80, the cumulative amount you’ve received in benefits is approximately the same whether you started benefits at age 62, 70 or somewhere in between.

As a rule of thumb, “if you’re single and believe that your life expectancy is less than 80, you should claim before 70. If you think you’re going to live past 80, wait until 70. When considering this, you should also account for your health, your lifestyle and your parents’ longevity as you gauge your potential life span.

A person who is eligible to receive $2,000 a month at a full retirement age of 66 and lives to 95 would receive almost $200,000 more in total benefits if he or she waited to claim at age 70 instead of at 62.

How can my spouse and I make the most of our combined benefits?

Married couples have more to consider to maximize their benefits, but they also have certain advantages. Even if one spouse never earned income covered by Social Security, he or she may claim benefits based on the other spouse’s record, as long as the other spouse has started claiming benefits. If you claim spousal benefits at your full retirement age, you get 50% of your spouse’s primary insurance amount (PIA)—that is, the benefit your spouse is eligible to receive at his or her full retirement age. If your husband or wife waited to claim benefits past full retirement age, the calculation of your spousal benefit does not include any delayed-retirement credits. And if you claim your spousal benefit between 62 and your full retirement age, the benefit is reduced.

If both members of a couple can claim benefits based on their own work history, the lower earner may still get spousal benefits if his or her own benefit is less than half of the other spouse’s PIA. In that case, the lower earner receives his or her own benefit plus an additional amount so that the total payout adds up to the maximum spousal benefit for which the lower earner is eligible.

Beyond the ins and outs of spousal benefits, there’s the question of when each spouse should start benefits. Ultimately, the spouse with the higher PIA should determine when to start benefits based primarily on the life expectancy of the spouse who is expected to live the longest. If at least one spouse is likely to live past 80, it often makes sense for the higher earner to delay claiming until age 70. Meanwhile, the lower-earning spouse may choose to claim his or her own benefits as early as 62 to gain some income. When one spouse dies, the surviving spouse receives 100% of the highest benefit.

Those who were born before January 2, 1954, can use a strategy called “restricting an application to spousal benefits.” Using this method, the higher-earning spouse can temporarily take a spousal benefit, which may prove lucrative in the long run. At full retirement age or later, the higher earner applies for spousal benefits while the lower earner collects his or her own benefit. Because the higher earner has reached full retirement age, he or she gets half of the lower earner’s primary insurance amount. During this time, the higher earner builds delayed-retirement credits on his or her own benefit, and at age 70, the higher earner switches to the boosted benefit. The lower earner switches to a spousal benefit if it’s higher than his or her own.

What about divorce?

If you are divorced and were married to your ex-spouse for at least 10 years, you can claim spousal benefits based on your ex’s record as long as you’re single now and the benefit to which you’re entitled based on your own work history is less than the spousal benefit. Even if your former spouse hasn’t applied for or suspended his or her own benefits, you can claim spousal benefits if your ex is 62 or older and you’ve been divorced for at least two years. Be aware that if you remarry, you’ll lose the spousal benefit—but you can reapply for it if you and your spouse divorce or he or she dies.

If you’re eligible for the spousal benefit for divorcees and aren’t close to retirement, don’t assume that it’s your best bet. You may be able to boost your own benefit higher than the spousal one by continuing to work because your Social Security benefits are based on the 35 years that you earned the most.

What about widows and widowers?

At age 60 (or as early as 50 for those who are disabled), widows and widowers may begin claiming survivor benefits based on their deceased spouse’s record. However, just because you’re eligible at 60 doesn’t mean it’s the right thing to do at 60. If you wait to take the survivor benefit at your full retirement age, you’ll get the same amount that your spouse was receiving or was eligible to receive. Claiming earlier reduces the benefit.

The size of your survivor benefit also depends on when your spouse died and whether he or she started claiming benefits during his or her lifetime. If your spouse had started claiming benefits, your maximum survivor benefit is the amount he or she was collecting. If your spouse died before full retirement age and had not yet claimed benefits, the survivor benefit is based on the amount your spouse would have obtained at full retirement age. And if your spouse died after his or her full retirement age and had not begun benefits, you’re eligible for the amount your spouse would have received at the age of death, including delayed-retirement credits.

An additional perk for widows and widowers: You can claim survivor benefits while letting your own benefit grow, then switch to receiving your own benefit later—a smart move if your benefit will exceed the survivor benefit. Or you may choose to start your own benefits at 62, then switch to survivor benefits at your full retirement age. Pursuing the optimal strategy can mean “hundreds of thousands of dollars of difference.

What happens if I start collecting Social Security before full retirement age and then go back to work?

If you work and collect Social Security before you reach full retirement age, the “earnings test” may decrease your benefit payout, depending on how much you earn. If you won’t reach full retirement age in 2023, you can earn up to $21,240 without affecting benefits (the earnings limit adjusts each year based on the national average wage index). For amounts above that threshold, Social Security withholds $1 in benefits for every $2 you earn. The year you turn your full retirement age, Social Security cuts you a break: The amount exempt from the earnings test is higher—in 2023, it’s $56,520—and the test applies only to the months prior to the month of your birthday. Plus, benefits are trimmed by $1 for each $3 earned.

Once you reach full retirement age, the earnings test vanishes. Note that income from investment earnings, retirement-account withdrawals and pensions does not fall under the earnings test, which applies only to earnings from a job or self-employment.

The earnings test may cause some pain while you’re working, but benefits withheld aren’t lost forever. Starting at your full retirement age, Social Security boosts your monthly check to make up for the missed benefits.

Are Medicare premiums automatically deducted from Social Security payments?

If you’re collecting Social Security checks when you become eligible for Medicare at age 65, your Medicare Part B premiums are automatically deducted from your benefit. If you aren’t receiving Social Security benefits when you’re ready to start Part B, you’ll have to enroll in Medicare separately, and you’ll get a bill for premiums. Medicare Part A, which covers hospital stays, has no premium for most people.

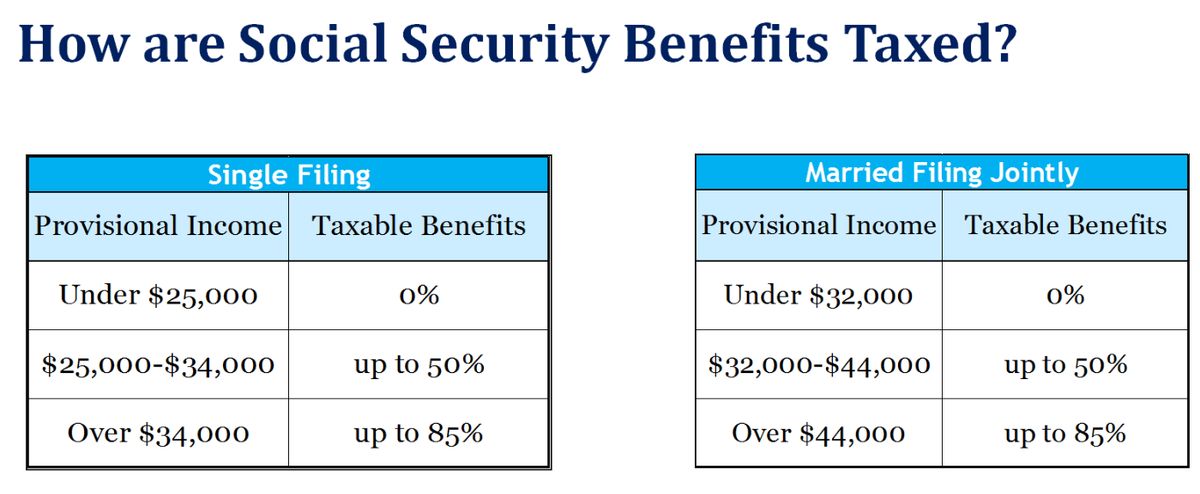

Taxes on Social Security

Some seniors are surprised—and dismayed—to discover that a portion of their benefits may be taxable. If all of your income comes from Social Security, your benefits probably won’t be taxed. However, if you have income from other sources, such as a part-time job, withdrawals from an IRA or a pension, up to 85% of your benefits could be taxed.