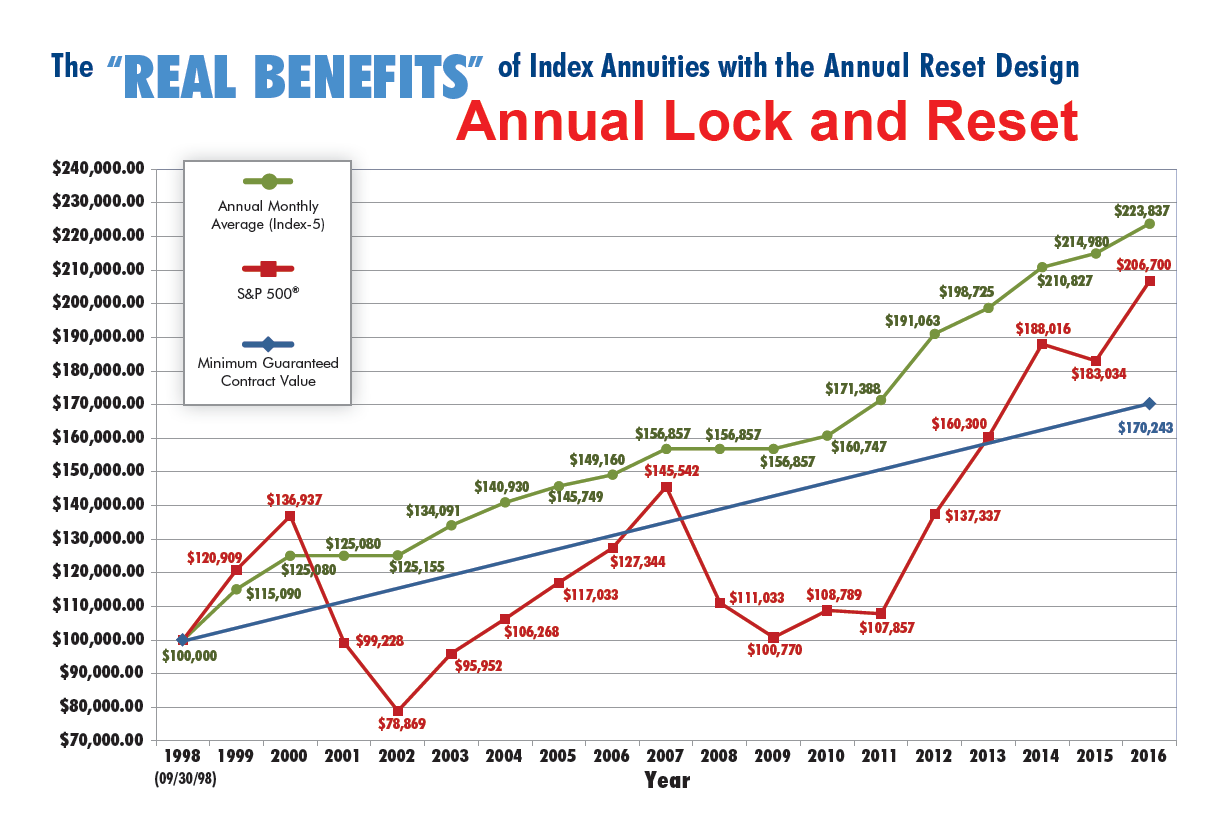

*The S&P 500 return figures do not include dividends, nor does the Indexed Annuity.

** Indexed Annuity returns are calculated using monthly averaging, 100% participation, no cap and 2.95% spread.

S&P 500 Index is an unmanaged group of securities considered to be representative of the stock market in general. One cannot invest directly into an index.

Past performance is no guarantee.

Monthly Averaging is defined as: The growth of the Index is measured monthly over a one-year period. At the end of the one-year period, the interest credited determined, in part, by comparing the average if the past 12 monthly index values with the value of the index at the beginning of the one-year period. The interest credited is locked in annually, and it will never be less than zero. In a volatile market, averaging moderates the highs and lows over a course of a year.

Participation rate is defined as: How much of the increase in the index that will be used to calculate index-linked interest.

Cap is defined as: The maximum interest rate that will be credited to the annuity for the year or period, or the maximum index growth upon which interest will be calculated. The Cap usually refers to the maximum interest credited after applying the participation rate or yield spread.

Spread is defined as: A deduction that comes off of the positive index growth at the end of the index term in the crediting calculation on an indexed product. Spreads may vary and year.