13 Questions About Safe Money Alternative for Your Retirement

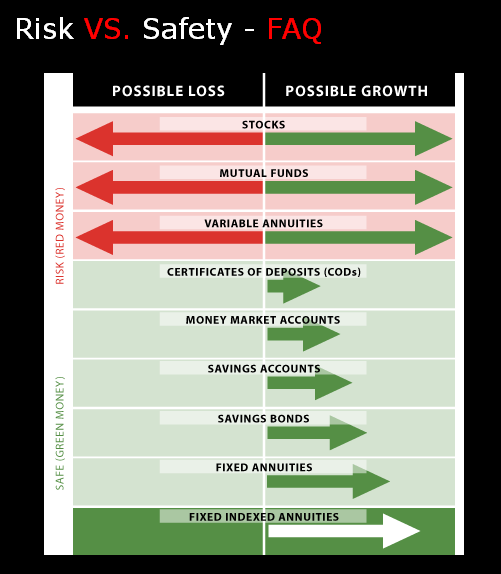

A Fixed Index Annuity (FIA) is a fixed annuity that can earn interest that is linked to the performance of a stock market index (S&P500 Dow Jones). FIA’s offer safety of principal, a guaranteed minimum return, and the ability to participate in market gains through an indexed link interest rate. When most people think of safe money places they think of banks. We want to educate you that there are other safe money places , many that you already rely on for all of your most valuable assets and possessions such as your home, car, boats and jewelry. Insurance companies are a safe money place to benefit yourself and your loved ones. The United States insurance companies have more assets than all the banks in the entire world combined. So isn’t it nice to know you can rely on them with your retirement accounts too! We have safe money alternatives that your broker and banker do not have. 50 million customers have 13 trillion in our products.

They offer the safety of your principal and minimum guaranteed returns. They are tax deferred vehicles offering triple compounding of your interest earned. They offer you the ability to earn interest tied to major indices without risking your principal offering more earning power. Free 10% withdrawals after year one on most contracts. No fees for RMD’s with IRA’s. Nursing home and terminal illness riders for more liquidity and guaranteed death benefits to your heirs. They also offer you lifetime income when you need it most, at retirement. Features will vary by product.

50 Million people in the United States have protected 13 trillion dollars in Fixed Annuities for retirement. Federal Reserve 401 (k) Dodges Stock Market Meltdown with Stable-Value Products. According to the 3rd quarter 2008 Federal Reserve and a Deloitte audit, which covers 22,000 employees at the Fed more than $3.15 billion or 69.7% of the $4.5 billion 401 (k) Thrift Plan for the Employees of the Federal Reserve System invested in its Fixed Income Fund. This fund is exclusively invested in stable-value group annuity contracts from major U.S. life insurance companies-not volatile mutual funds. Source: International Business Times 12/2/2008. Ben Bernanke, our Nation’s Chairman, largest assets were two annuities valued between 500,001-$1 million” source: Merrill Lynch June 21, 2009.

Yes, your principal, bonus money, and any interest earned are protected from any market declines. The index annuity is as safe as the insurance company that issues it. States and independent rating firms examine financial books of insurance companies on a regular basis. Insurance companies are highly regulated, and there are many safeguards in place that regulators require to help protect your money. We suggest you contact your state insurance department or state insurance guarantee fund for more information about such protection.

FIA’s are designed for long term accumulation of your money. In exchange for a long term commitment it allows the insurance carrier to invest and in return make a profit in exchange for providing you with upfront bonuses and protecting your principal and providing lifetime income.

7,000 baby boomers retire everyday and they are looking for the ability to protect the money they have while maintaining the same lifestyle they are currently enjoying without jeopardizing their future with their retirement accounts. People buy FIA’s because they are not satisfied with low yielding CD’s and cannot afford the risk of the stock market or do not have the time for it. They protect their old 401K’s, IRA’s or any retirement money with these products.

Variable annuities have mortality and expense fees averaging 1.25% per contract, FIA’s do not. Variable annuities have sub account fees, FIA’s do not. Variable annuities do not protect your principal from market losses, FIA’S do. A variable annuity owner’s money is directly in the market and an FIA’s money is linked to the market. A variable annuity contract can go up and down in value based on market performance; an FIA’s can only go up. A variable annuity is a security which requires a prospectus. An FIA is an insurance product not a security and therefore does not require a prospectus. A variable annuity owner owns the volatility of the market while an FIA owner controls the volatility of the market.

No. The insurance company has costs to provide you with the downside protection against loss; therefore the upside is based on caps or participation rates issued by the individual insurance carriers. This means you will not fully participate in all of the gains if the market goes up in exchange for participating in none of the market losses.

No. FIA’s have many different time frames, most range from 1-15 years. They all have different surrender charge periods and percentages. They may have different indexing options within the different contracts. They offer different bonuses from 5-11% up front. They offer different LIBR’s, Lifetime Income Benefit Riders, ranging from 5-8% per year for future income. Based on your individual needs, liquid assets, and total portfolio or if you are using qualified money (IRA’s 401K) or non-qualified money, certain annuities meet different objectives.

This is based on your allocations each and every year. In linking to an index we have seen interest credits in the double digit range. These contracts are not designed to compete with Wall Street or stocks and mutual funds. They were designed to potentially bring greater returns than CD’s and provide safety of principal with lifetime income when you need it most at retirement. Past performance does not indicate future performance.

This is not interest earned. You have two accounts within this one annuity. Your cash value account which is your principal, plus any bonus, plus any interest you make utilizing the indices or the fixed accounts. You have a (LIBR), Lifetime Income Benefit Rider. This account grows at 8% per year for future income calculations. It is not your real cash value yet it provides a real annual income down the road when you need it most. Based on your age when you withdraw it gives you a percentage of the full account value in the LIBR.

Most annuities have declining surrender charges. I.E. a 10 year annuity may have a surrender charge of 10% in year one, 9% in year two, 8% in year 3, and so on down to the tenth year. Thus if you leave early a penalty exists. Again, these are designed for long term accumulation, most offering 10% free withdrawals of 100% of your account values every year, after Year One, which provides liquidity if needed. This can vary by product.

As with any other insurance product you must consider what your objectives are with this type of product. Based on your time horizon, other assets both liquid and non-liquid, financial objectives of future income for retirement or not. These are all essential factors in determining which product is right for you. Contact us today and one of our professionals will assist you with choosing which plan is right for you.

By Utilizing our program, you will Retain Your Gains i.e. Any gains you receive will be yours to keep regardless of what happens in the future, and you will be able to receive a predictable and guaranteed paycheck for the rest of your life.

Click here to contact us for more information and a no-charge consultation with one of our annuity experts.